How to start investing in Pokémon cards

-

By: Oliver Copeland

- Published:

- Last Updated: December 2, 2023

Pokémon cards took the world by storm back in 1999 and if your mom didn’t sell them at a garage sale, you’re in possession of some amazing collectibles and perhaps itching to obtain more. However, it is important to do your research before buying any Pokémon cards, as not all are created equal in terms of value. So, are Pokémon cards a good investment? The answer depends on the card and on the current market conditions.

Purchasing sealed products (especially vintage) is the lowest risk method of investing in Pokémon cards. Another good place to start is by purchasing fan-favorite Pokémon cards such as Charizard or Pikachu.

Definition of investing

“expend money with the expectation of achieving a profit or material result by putting it into financial plans, shares, or property, or by using it to develop a commercial venture.” -Oxford Languages

It’s important to stay grounded by occasionally reflecting on the actual definition of investing. Opening Pokémon booster packs are essentially gambling and can become addicting. Just because someone is buying cards does not mean that they are ‘investing’.

However, purchasing carefully selected cards for the purpose of gaining value, is investing.

Is it a good time to invest in Pokémon cards?

Yes, probably.

The best time to invest in Pokémon cards is long gone and will never present itself like it did in the early 2000s. It’s best to accept that the golden age is over and move on.

The market tends to rise and fall but overall remains fairly steady. Is it likely that we will see another big boom in the hobby? Probably not for a long time. The COVID19 pandemic was responsible for prices sky-rocketing, but those prices have mostly come down now.

There won’t be another golden age, so it’s best to focus on individual cards that you think will go up in value.

Which Pokémon cards to invest in

As with most investing methods, there is a delicate balance between risk and reward.

A low-risk Pokémon card investment would be, for example, a Base Set Charizard. This card is for sure going to rise in value over time. A High-risk Pokémon card investment would be something like a recently released card that isn’t really sought-after.

Low-risk investment ideas | High-risk investment ideas |

|

|

Investing in Pokémon sealed products

The best investments are perhaps vintage sealed products. This includes booster packs, booster boxes, decks, and other products.

Supply and demand are the keys here. Vintage products are out of print (obviously) so every time one is opened, supply falls just a little bit. As supply falls, your vintage products slowly become more valuable. There is virtually no way that the value will ever decrease over time.

Investing in modern sealed products is a smart idea too, but you have to pay close attention to, again, supply and demand. For example, the Pokémon Celebrations set was released at the absolute height of the Pokémon boom in 2021. For this reason, many people purchased products to keep sealed. In a few years, there will still be a huge amount of sealed Celebrations products. Yes, they will make a return on their investment, but not as much as perhaps a different TCG product.

Investing for kids

A common complaint about the public school system is that the curriculum does not include investing. Well, consider Pokémon cards as a vehicle for investment education.

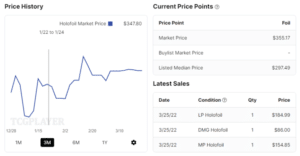

If you have kids who are interested in Pokémon, this is a chance for them to learn the basics of investing: Buy low, sell high, supply and demand. Many modern cards can be purchased for ~$10 and tend to rise and fall in the card market. A great place to check current market conditions is tcgplayer.com, where each card has a small graph indicating the latest market fluctuations.

Final thoughts

Investing is a good idea if you’re ready to do the research and spend your money in a smart way. Investing in Pokémon cards is fun if you’re a collector yourself, or if you want to engage in a fun hobby with your kids.